KEY TAKEAWAYS

Clients that allocated media budget and booked placements in Q4 saw 3x higher ROI than clients who did not.

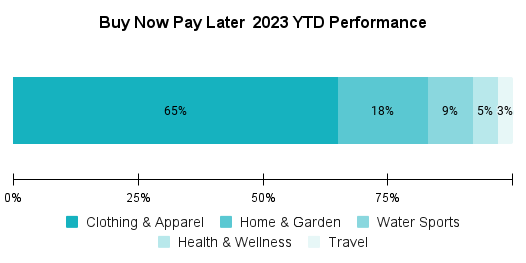

Our BuyNowPayLater publishers are currently performing the highest with our Clothing & Apparel clients at 65% of the overall revenue.

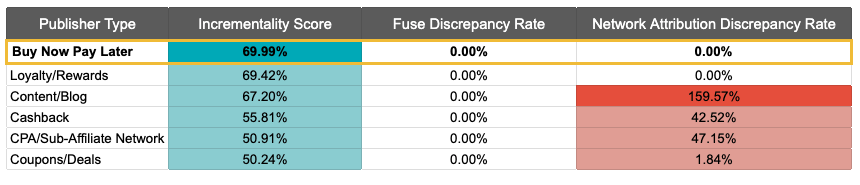

By pairing with PartnerCentric’s FUSE technology, our Incrementality Index delivers enhanced visibility into publisher-level performance while automating commission payments based on partners’ influence in the customer journey.

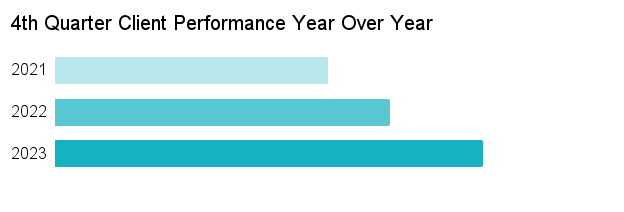

PartnerCentric clients saw an increase of 22% YoY growth in performance in 2022’s 4th quarter.

Based on our current client performance trends, we are predicting 2023 to exceed 28% growth YoY.

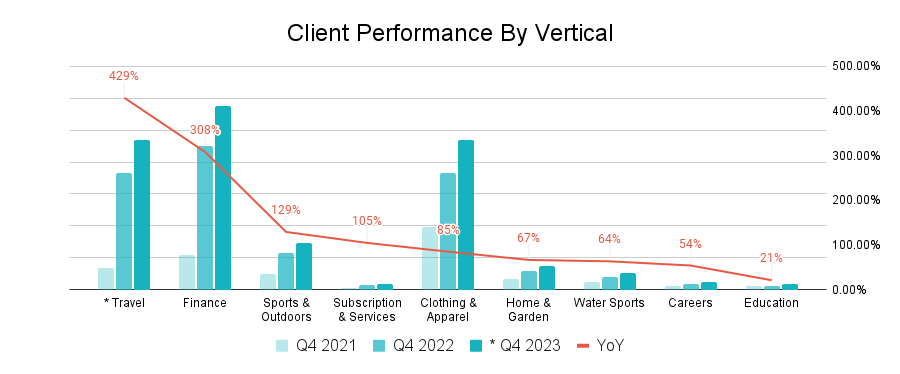

In 2022’s 4th quarter, many verticals saw a significant increase in performance YoY. The highest vertical growth was with our Travel and Financial clients.

Every quarter in the year has its own unique opportunities and challenges. Our account management teams approach each quarter with a proactive and strategic plan in place to negotiate placements and optimize publishers to their full potential.

Based on current trends we anticipate to see even more growth in 2023’s 4th quarter with our Travel and Subscription clients as well as the average historical growth of 75% with our retail clients in Clothing & Apparel and Home & Garden.

Clients that allocated media budget and booked placements in Q4 saw 3X higher ROI than clients who did not.

* The Q4 2023 represents the average projected growth of 28%.

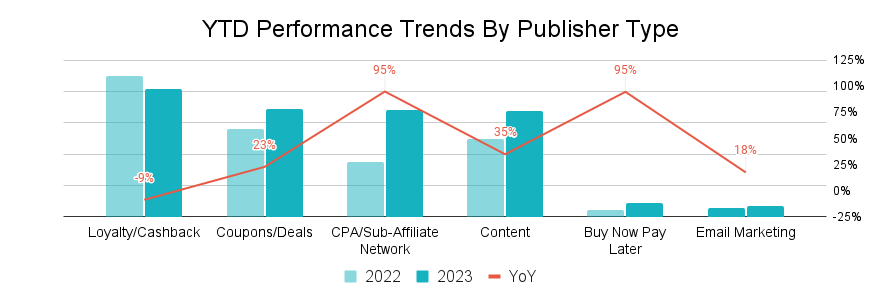

Along with our historical 4th quarter performance we also analyzed how our publishers are performing YTD in 2023.

Although we have seen growth across the board with multiple publisher types, a recent stand out last year was our BuyNowPayLater publishers with 95% YoY growth.

Loyalty/Cashback publishers have generated the most revenue YTD but are down -9% YoY. The main contributors to the decrease are Honey ( -20% YoY) and Rakuten ( -14% YoY). Other Loyalty partners such as Bing Rebates and Cartera are up YoY by 87%. Based on historical Q4 data that show loyalty/cashback partners are customarily a large revenue driver and increase YoY in Q4, we foresee them to be a main revenue driver this coming Q4 2023.

The Buy Now Pay Later short term finance option which allows consumers to make purchases and pay for them at a future date continues to grow in popularity post-pandemic. According to Investopedia, The Buy Now Pay Later market could surge to nearly $3.7 trillion by 2023 as more consumers take advantage of the alternative finance option. We see this upward industry trend in the affiliate marketing channel as well.

Our BuyNowPayLater publishers are currently performing the highest with our Clothing & Apparel clients at 65% of the overall revenue.

Home & Garden are seeing consistent growth as well. They currently hold 18% of the revenue generated from BuyNowPayLater partners. We anticipate this to increase and exceed 28% by year end.

By pairing with PartnerCentric’s FUSE technology, the Incrementality Index delivers enhanced visibility into publisher-level performance while automating commission payments based on partners’ influence in the customer journey.

At PartnerCentric our account management teams are hitting the ground running to prepare for Q4 2023. Along with securing the best placements for well known cyber days, we are creating custom strategies to ensure our clients have every advantage and find the highest success this Q4 2023.

“The PartnerCentric team has been instrumental in our growth and success in the affiliate channel. Their team is able to adhere to all of the strict guidelines around partnerships and always identify and, more importantly, qualify the right opportunities so we can guarantee we’ll be successful.”

Katie, Hims

“We had very stringent performance metrics for our growth programs, and we had a limited set of ideas we were committed to in order to reach those goals. PartnerCentric’s respect for those KPIs even as they proposed new partnerships and opportunities helped us test more courageously. In the end, these innovative solutions raised the bar and delivered the growth we needed.”

Katie, Hims

More Case Studies >

To learn more about how PartnerCentric can strategically grow your business, get in touch.