April 30, 2025

BNPL on the Rise: 65% of Gen Zers Using BNPL More in 2025

How Buy Now, Pay Later Is Changing Consumer Behavior and Conversions

Buy Now, Pay Later (BNPL) has reshaped how Americans shop online. What began as a simple way to split up large purchases has become a preferred payment method for everything from groceries to gadgets. Brands that embrace this trend are seeing higher conversions and deeper consumer loyalty. To understand BNPL’s growing impact, PartnerCentric surveyed over 1,000 Americans and analyzed internal client data to uncover how this payment method influences behavior, conversions, and brand performance.

Key Takeaways in This Blog

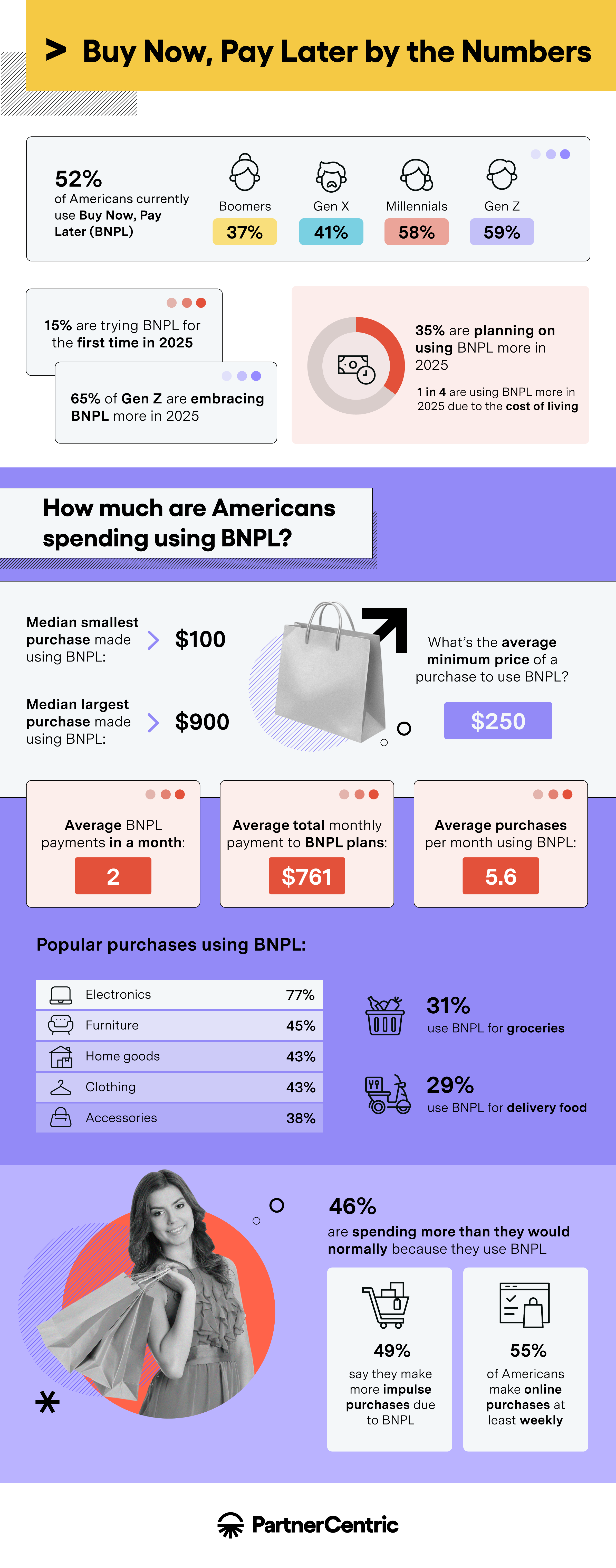

- BNPL adoption continues to climb. Over half (52%) of Americans now use BNPL, with Gen Z and Millennials leading adoption at 59% and 58%, respectively.

- Economic factors are driving usage. 1 in 4 consumers say they’re using BNPL more due to cost-of-living pressures.

- BNPL influences bigger purchases—and everyday ones. Electronics and furniture top the list, but 31% use BNPL for groceries and 29% for delivery food.

- PartnerCentric data shows lift across industries. BNPL integrations increased performance in Sports & Recreation (21%), Home & Garden (8.6%), Food & Gifts (8.2%), and Apparel (7%).

- BNPL drives incremental revenue. Advertisers using BNPL partners saw an average 39% increase in conversions, proving it’s not just convenient—it’s effective.

Why Did We Look Into BNPL Data So Closely?

Anyone who’s bought something online in the last decade or so has probably seen it: amid more well-known payment options like credit or debit, a BNPL option appears. BNPL is an interest-free way to break up purchases into (typically) four smaller payments that, unlike credit cards, does not currently affect credit scores. The BNPL industry has witnessed a meteoric rise in popularity and is slated to fetch payment values of $125B by 2027.

We wanted to know how Americans approach BNPL– are they saving it for larger purchases only, or are they embracing BNPL for everything from their delivery burritos on DoorDash to groceries, concert tickets, and more? We asked over 1,000 Americans nationwide about their past and future use of BNPL in order to gather useful data and insights into what makes BNPL tick.

Over half of Americans Use BNPL Now; 15% Will Try it for the First Time in 2025

BNPL is widely used; over half (52%) of Americans use BNPL currently, with Gen Z and Millennials leading the way in the market at 59% and 58% respectively. Just under 2 in 5 Gen Xers and Boomers use the method; this is a payment option more popular with youth, so much so that data shows 65% of Gen Zers are planning on using the platform more this year.

Interestingly, 15% overall are trying BNPL for the first time in 2025, and 35% are planning on using BNPL more in 2025. At least 1 in 4 are embracing the payment method more explicitly due to the cost of living, perhaps because it helps stretch paychecks further.

BNPL was first conceived as a way to break up larger purchases and serve as a delayed payment method so consumers could buy online and make their payments once they were happy with their goods; is that still its primary use? The median smallest purchase made using BNPL among Americans is $100, while the largest purchase made with BNPL amounts to $900. Internal PartnerCentric data shows that the median Average Order Value (AOV) was roughly $127 for our clients using BNPL, and that merchants with smaller AOVs saw a higher rate of purchase when using BNPL.

When asked where price may drive the decision to switch from paying in full to BNPL, the median response was $250. Americans average roughly 2 BNPL payments in any given month, and the average total monthly payments across plans is $761. Consumers make an average of 5 purchases monthly using BNPL.

Electronics are the most popular commodity bought using BNPL, followed by furniture, home goods, clothing, and accessories– all potentially big ticket items for the average American consumer. Then again, 31% say they use BNPL for groceries, and 29% also use it for delivery food.

PartnerCentric internal data shows that the following industries saw the highest lift when working with BNPL partners:

- Sports & Recreation (21.0%)

- Home & Garden (8.6%)

- Food & Gifts (8.2%)

- Clothing/Apparel (7.0%)

Nearly half of Americans using BNPL say they’re spending more than they would without the option; potentially due to impulse purchasing. In fact, nearly half (49%) say they make more impulse buys due to BNPL. Reducing immediate wallet impact certainly has an effect!

3 in 4 BNPL Users Prefer it to Credit Cards

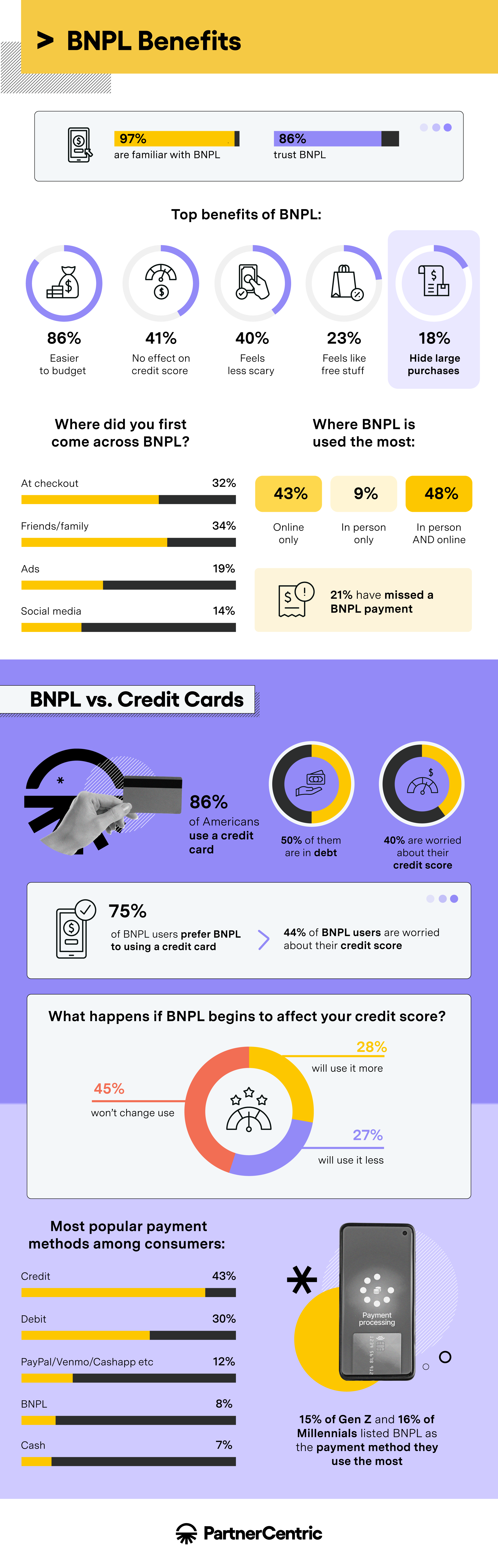

Nearly all Americans are familiar with BNPL despite its recency; 86% also trust BNPL as a payment method.

Top Benefits of BNPL

- Easier to budget 86%

- No effect on credit score 41%

- Feels less scary 40%

- Feels like free stuff 23%

- Hide large purchases 18%

Clearly Americans see diverse value in BNPL, with 18% citing its ability to hide large purchases from bank statements as a benefit.

Interestingly, many BNPL users (32%) first discovered the payment method at the point of checkout and decided to try it. Another 34% heard about it from friends and/or family; only just under 1 in 5 heard about BNPL through ads, and even less (14%) through social media.

Over 2 in 5 (43%) use BNPL online only, while just 9% use it in person only; the remaining half (48%) use it in person and online. When asked about potential future applications of BNPL, medical payments and insurance payments were popular options for future BNPL opportunities.

Remarkably, despite such widespread use, only 21% have missed a BNPL payment– a testament to the platform’s ease among consumers.

BNPL Threatens to Dethrone the Credit Card

Credit cards are the most popular payment method among American consumers. 86% of Americans use one; of them, 50% are in debt and 40% worry about their credit scores.

Three in 4 BNPL users prefer using BNPL to a credit card; 44% of BNPL users are concerned about their credit score, which makes sense given the relatively youthful user base. Recently, Experian announced that it would begin to incorporate Affirm BNPL data into its credit monitoring and reporting metrics, which means that BNPL purchases made through Affirm might soon affect one’s credit score. Users had a mixed reaction: 28% said they’d use BNPL more with this in mind, while 27% said they would use it less. The remainder– 45% – were unbothered and said they wouldn’t change their use patterns.

Overall, the most popular method of payment is the credit card, followed by debit, online direct payment platforms like PayPal, BNPL, and finally cash (no longer king in 2025). Interestingly, 15% of Gen Z and 16% of Millennials listed BNPL as the payment method they used the most.

All in all, BNPL has a clear benefit– and advertisers that use BNPL boost their conversions by an average of 39%! As more users embrace the payment provider, there’s great potential to earn more conversions and make it easier on would-be customers. As the cost of living continues to be high, BNPL is clearly there for those who need it.

Ready to Take the Next Step?

As BNPL reshapes ecommerce, understanding how it aligns with your audience is essential. PartnerCentric helps brands evaluate, onboard, and optimize BNPL partnerships to boost conversions and customer retention.

Whether you’re exploring new fintech partnerships or refining your existing payment ecosystem, our data-driven approach ensures BNPL becomes a growth lever—not just another checkout option. Let’s uncover how BNPL can lift your brand’s performance. Connect with a PartnerCentric expert today.

FAQs: Understanding Buy Now, Pay Later

Q: What is BNPL and how does it work?

BNPL (Buy Now, Pay Later) lets consumers split purchases into smaller, interest-free payments. Unlike traditional credit, it doesn’t typically affect credit scores—though major providers like Affirm are beginning to report select transactions to credit bureaus.

Q: Who uses BNPL the most?

Gen Z and Millennials lead adoption, often viewing BNPL as a more flexible, budget-friendly alternative to credit cards. However, usage is growing across all demographics as consumers seek smarter ways to manage spending.

Q: What types of purchases are consumers making with BNPL?

Electronics, furniture, home goods, and apparel remain the most common categories—but increasing numbers of consumers now use BNPL for essentials like groceries, dining, and delivery.

Q: How does BNPL impact ecommerce performance?

By reducing immediate cost barriers, BNPL increases average order value (AOV) and conversion rates. PartnerCentric’s internal analysis shows advertisers who implemented BNPL saw a 39% boost in conversions.

Q: Does BNPL pose risks to consumers or brands?

While BNPL can encourage impulse buying, most users manage payments effectively—only 21% report missing one. For brands, the key is working with trusted providers and tracking performance metrics closely to ensure responsible adoption and ROI.

Q: How can PartnerCentric help brands integrate BNPL?

PartnerCentric assists with partner evaluation, implementation strategy, and ongoing performance tracking to ensure your BNPL partnerships deliver measurable incremental growth.

Methodology & Fair Use

In April 2025, we surveyed 1,006 Americans on their use of BNPL and other payment platforms. 49% were women, 50% men, and 1% either nonbinary or chose not to disclose. Ages ranged from 19-75 with an average age of 37.

PartnerCentric’s BNPL Onboarding Impact Methodology: Analysis conducted using proprietary internal performance data from PartnerCentric, spanning April 2022 to March 2025 for 14 advertisers across five verticals. Monthly order and revenue outcomes were evaluated over a six-month post-onboarding window, with a secondary three-month window used for comparative growth analysis; BNPL partners assessed include Afterpay, Affirm, Klarna, and Zip Co US.

For media inquiries, please contact media@digitalthirdcoast.net

Fair use: When using this data and research, please attribute by linking to this study and citing PartnerCentric.com.

Ready for better

This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.